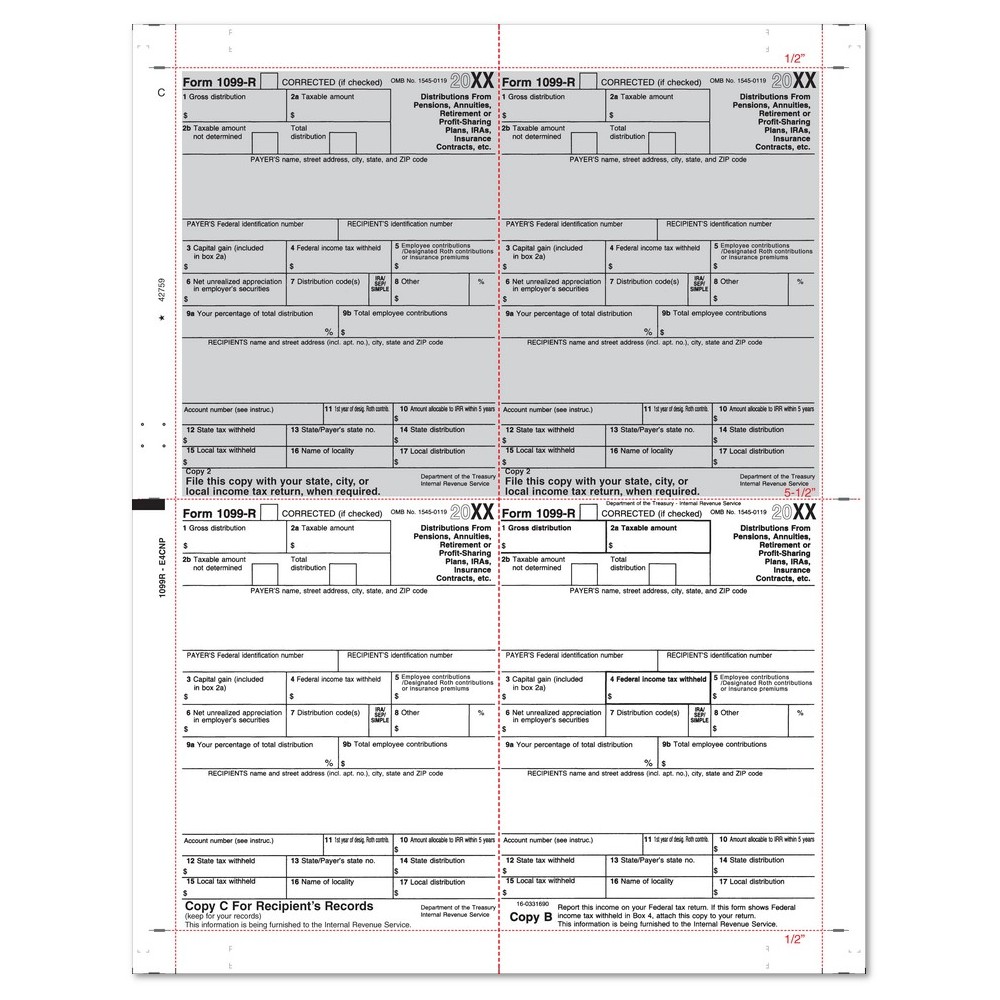

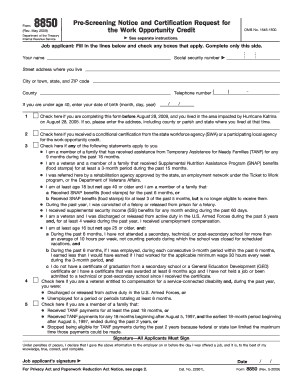

The second wife argued that the decree did not expressly state the name of the plan. The decree stated the amount assigned –100% of the policy proceeds, in one single payment. Since the parties could actually be contacted through the home, their mailing addresses were effectively specified. It did not state their mailing addresses, but it did state the address of the former marital home, which had not yet been sold at the time of divorce. The decree expressly assigned benefits to the wife, and it did not require the plan to make payments that the employee had not earned. So the key question was whether the divorce decree, which incorporated the agreement, was a QDRO. (d) Summary of Rationale: ERISA generally prohibits the assignment of ERISA-regulated benefits, but not if the assignment is made in a QDRO. (b) Issue: Who is entitled to the policy proceeds? Upon his death, both wives claimed the proceeds, and the insurer filed an interpleader action in federal court. Their divorce decree incorporated a property settlement agreement providing that the husband would name the wife as beneficiary of his employer-provided life insurance.ĭespite the agreement, the husband named his second wife as beneficiary of the policy. (a) Facts: Husband wife were divorced in Florida. Finally, since both parties were unable to claim their respective child as a dependent the Child Tax Credit was not allowed. In addition, the court noted that the Child Tax Credit was unavailable. There must be an unconditional release of the right of the ex-wife to not claim the son as a dependent for the year in issue. In addition, the court noted that the statute allows the custodial parent to transfer that claim to the non-custodial parent “by written release” which was not done. 152(e)(2) requires that the taxpayer to attach a “written declaration signed by the custodial parent declaring the custodial parent “will not claim” the child as a dependent in that calendar year. The ex-husband also claimed that he was entitled to equitable relief. 152(e)(2)(A) was ambiguous because the statute does not define “written declaration.” The ex-husband also noted that state courts often allocate the federal dependency during divorce proceedings and that the principles of federalism required the IRS and federal courts to respect those allocations.

The ex-husband argued that the Congress intended that the parent entitled to the deduction be the one who receives it, and that I.R.C.

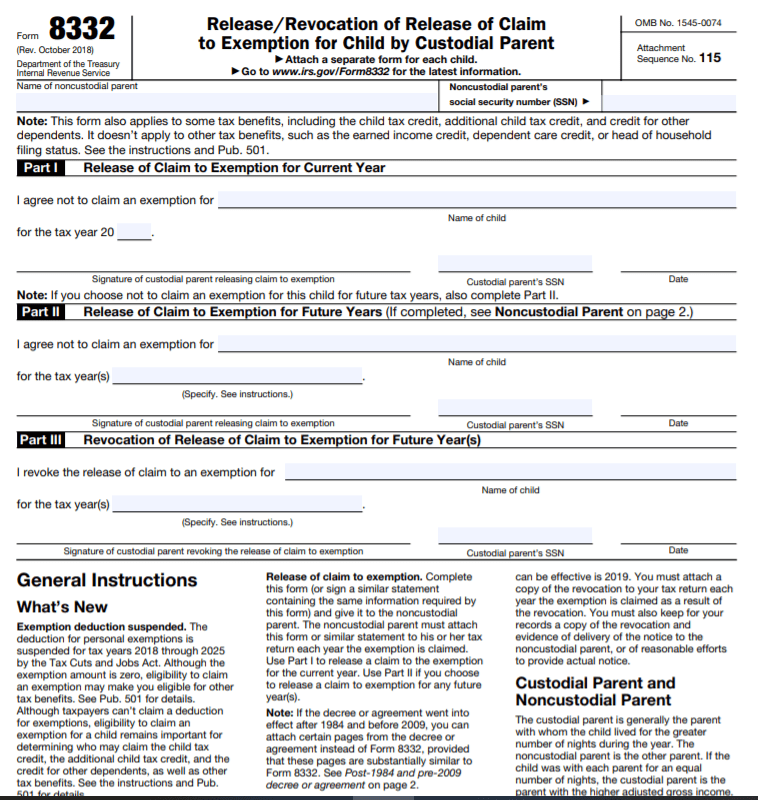

IRS issued a notice of deficiency denying the child exemption for the ex-husband. Ex-husband was current on child support, but ex-wife did not execute and provide Form 8332. For the tax year at issue, the couple did not attach Form 8332 to the return, but did attach a copy of a 2003 arbitration award that allocated the exemption for the child to the ex-husband which allowed the ex-husband to claim the child and conditioned ex-wife providing ex-husband Form 8332 on ex-husband being current on child support payments in accordance with the divorce decree as of the end of the tax year.

In this case, a married couple divorced with the ex-wife having custody of their son.

0 kommentar(er)

0 kommentar(er)